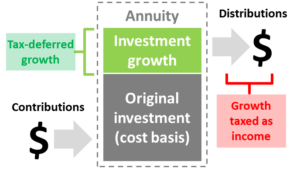

Like many advisors, I often find myself reviewing accounts and historical performance for clients and prospects with investments at other firms. Of course, I see all the usual suspects like annuities, mutual funds with loads, 12B-1 fees, etc. Financial professionals who work on a commission basis regularly tuck these products into their clients’ portfolios – whether or not they are the best option (they just have to be suitable). These issues are nothing new and there are already many efforts devoted to educating clients around these potential conflicts of interest (e.g., FINRA).

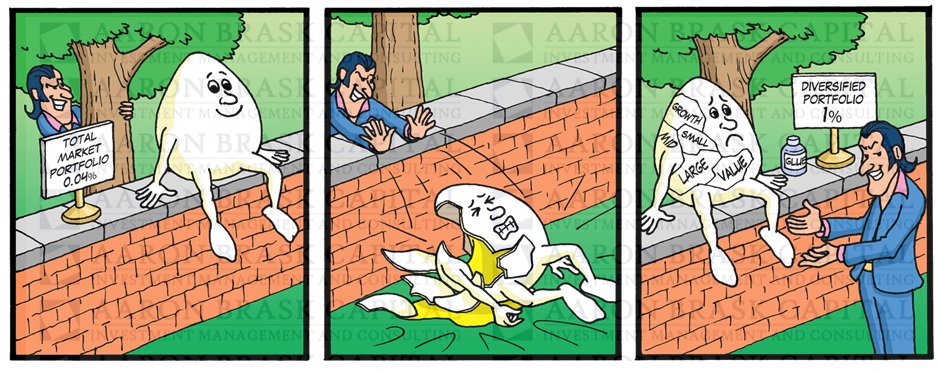

This short note focuses on a different issue I regularly come across that gets under my skin. In particular, it is common practice for many financial professionals to build portfolios with various mutual funds, ETFs, and third-party managers. However, these portfolios, in aggregate, often strongly resemble the total market portfolio (which is available for ultra-low fees for various products providers including Vanguard and Blackrock).

For example, many of the large wirehouses use a variety of different active managers and funds. While each may employ a different strategy, their strategies often diversify themselves away. One manager over-weights what another under-weights and so forth. This observation is really just a statistical version of William Sharpe’s mathematical argument regarding active management in aggregate (a notion Jack Bogle has often repeated in marketing Vanguard’s index products).

The end result can be a portfolio that is very similar to the total market. Unfortunately, all of the expertise and effort to build this portfolio wind up costing significantly more than just purchasing a total market index fund. Indeed, both the advisor who constructed the portfolio and the funds themselves typically levy fees that can add up to as much as 1-2% per year.

This begs the question of why bother?

I can think of at least three reasons. Giving the benefit of the doubt to advisors who employ such strategies, the first reason may just be ignorance; they do not know any better. This may sound surprising but I suspect it is often the case as many investment professionals focus more on sales than investment strategy. A second reason might be that advisors want to have the appearance of adding value. When a client looks at their statement and sees all of the different holdings, they likely assume they were strategically chosen based on the extensive experience of the advisor and/or advisor’s firm. The third reason is that many of the larger firms operate pay-to-play schemes whereby they also get fees from the fund companies. In my view, this last factor is really just a lesser-known version of the 12B-1 fee as it creates conflicts of interest at the firm level (offering or perhaps focusing on selling funds that pay them).

To be fair, active funds and managers are not the only way to play this game. Indeed, I have seen independent firms play a similar game with index funds while touting their ultra-low fees (a difficult pitch to resist for many investors). I cannot count the number of times I have seen portfolios diversified between growth and value, large and small, etc. In my mind, this is not much different than charging a fee for breaking the market into smaller pieces and gluing them back together.

I acknowledge some advisors may argue the granularity provides them with the opportunity for strategic rebalancing (e.g., tax harvesting). In my experience, however, this is often not the case. The portfolios are built for the appearance of diversification but end up paying unnecessary fees.