| Disclaimer: I am not a tax professional. This article is not and should not be construed as tax advice. Investors should seek advice from a CPA or qualified tax professional for any questions or issues related to taxes. |

| I received interesting feedback based on varying interpretations of a recent article I wrote (’Quantifying the Value of Retirement Accounts’). Unfortunately, much of this feedback provided further evidence of the flawed logic and assumptions many (even professionals) use in the context of financial planning with retirement accounts (e.g., IRAs).

In the following, I attempt to clear up some of the confusion around the assumptions, logic, and results discussed in my previous article. I first provide a generalized framework in order to identify the primary variables that are relevant when making decisions around retirement accounts. I then provide hypothetical examples to illustrate how one might sensibly leverage this framework and the results from my previous article. |

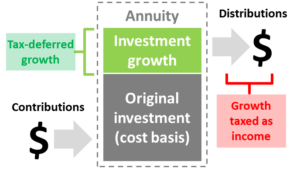

Figure 1: Generalized Framework for Retirement Account Decisions

Source: Aaron Brask Capital

Overview

A recent article I wrote attempted to isolate and quantify the immense value provided by retirement accounts stemming from not having to pay taxes on investment income and rebalancing (i.e., dividends, interest, and capital gains). Unfortunately, the crux of the article was lost on many – as evidenced by the feedback I received.

To be fair, I take responsibility for some of the confusion. The graphic at the beginning of the article (same as above) intentionally made some strawman assumptions that I debunked later in the article (and alluded to in the abstract). However, it seems many people did not bother to read the executive summary or get past the front page. Hopefully this article will help clear up the confusion.

The following is organized in two sections with a conclusion at the end. The first section describes a general framework highlighting the primary variables I believe are relevant to making decisions around retirement accounts. The second section presents examples that should help clarify how one can sensibly leverage the results from my prior paper where I attempted to quantify the tax benefits of retirement accounts.

A general framework

As I highlighted in my previous article, many people are making incorrect assumptions around the purpose of retirement accounts. For example, many (even financial professionals) claim that deferring income taxes is the primary benefit of establishing and funding 401Ks and IRAs. This is simply not true and can actually backfire. More generally, I believe it is just plain dangerous to rely on rules of thumb for financial planning. A comprehensive and robust framework is necessary to ensure good decisions. That is why this section attempts to summarize the primary variables relevant to retirement planning.

In general, one cannot allocate funds to a qualified retirement account (e.g., 401K or IRA) unless they are earning money[1]. So here I will observe the fate of an earned dollar through various retirement contribution scenarios up until it is ultimately spent. In my view, there are three moving parts we must account for in order to calculate how much each dollar will grow into and be available to for spending[2].

The first factor is the relevant income tax rate. One could choose to pay taxes when the dollar is earned (e.g., taking the cash outright or funding a Roth-type retirement account) or they could defer those taxes by contributing to a retirement account like a 401K or traditional IRA. While calculating one’s current tax rates is typically straightforward, knowing which earning/tax bracket or what the corresponding income tax rates will be is naturally less predictable. Notwithstanding, there are many cases where one may be able to assume their tax rates will be significantly higher or lower down the road.

The second factor affecting the growth of this earned dollar is the rate of return it experiences while it is invested. In particular, dollars in qualified retirement accounts will enjoy significant benefits in the form of bypassing taxes on dividends, interest, and capital gains. This was the primary focus of my previous article where I attempted to quantify the benefit as an annual rate of return.

The third factor I consider here is the time frame. This directly relates to the second factor as it determines how long the rate of return will be compounded. In my experience, many investors and investment professionals overlook or underestimate this variable in the planning process. However, it can have a very significant impact.

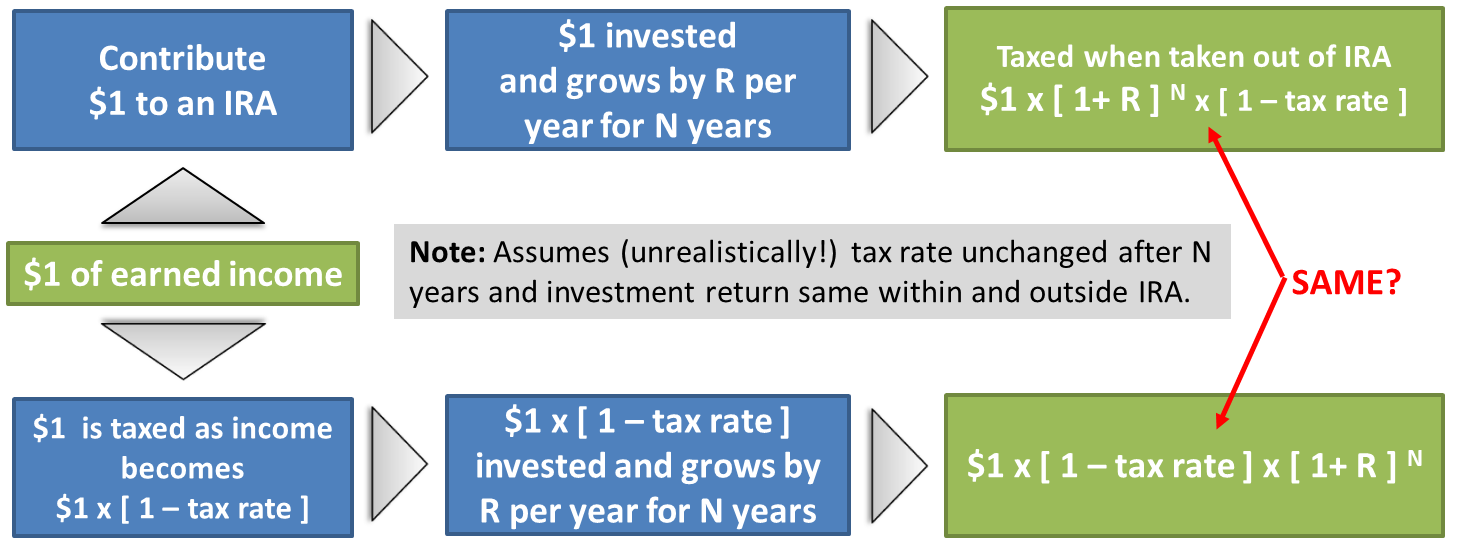

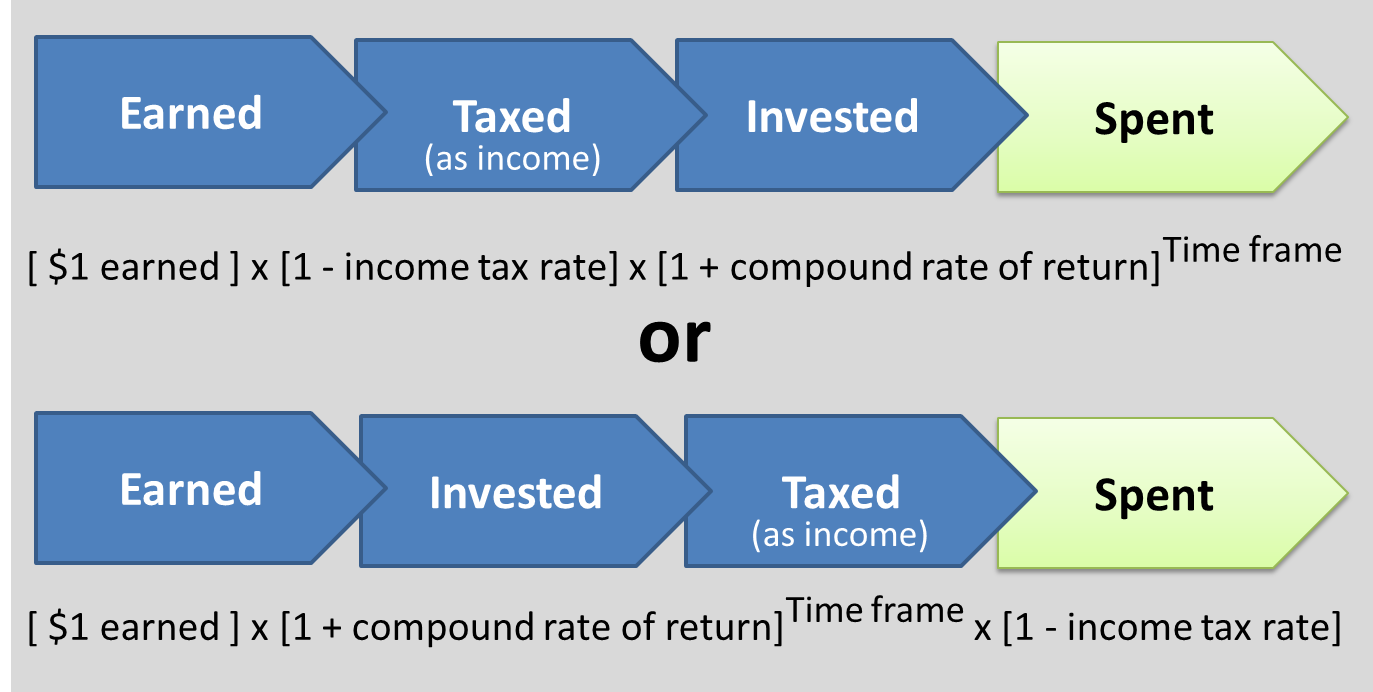

Figure 2: Three-variable model for the future value of an earned dollar

Source: Aaron Brask Capital

The figure above illustrates these three variables and mathematically expresses their combined impact on the future value of an earned dollar based. It is important to consider these variables in aggregate and not just in isolation since they interact with each other. Based on the feedback from my previous article, it is clear many people (even practicing financial professionals) do not get this point and sometimes focus on only one variable.

It is also important to simulate different outcomes for these variables since we cannot predict them in advance (e.g., returns or future tax rates). Indeed, it is possible for a small change in one variable to have a significant impact on the overall result. The examples in the following section help illustrate these points.

Lastly, the mathematical expression corresponding to the top (bottom) diagram above appears to impose the income tax before (after) the money is invested. In the case of a 401K or IRA contribution, the tax would be imposed after the investment period. In the case of a Roth or no contribution, the tax would be imposed before the investment period. However, my point is just that the order of the figures in those mathematical expressions does not actually matter due to the commutative properties of multiplication (e.g., 3 x 4 = 4 x 3).

Useful examples

This section discusses two examples to illustrate how one can sensibly use the results from my previous paper to facilitate decisions around planning with retirement accounts. The first example compares an investment dollar allocated to an IRA versus a taxable brokerage account. The second example compares a traditional IRA to a Roth IRA.

In my previous article, I used historical market simulations to make precise calculations for various investor scenarios (e.g., tax brackets, portfolio composition, and intention to liquidate or not). My goal was to come up with rules of thumb to summarize the potential tax benefits of retirement accounts. As such, the following two examples will leverage those results and rules of thumb rather than rerun the simulations. This will avoid many of the tedious details (e.g., portfolio rebalancing and tax lot optimization) and should help illustrate what I believe is a useful conceptual model for planning with retirement accounts.

| Note: To be clear, the following two examples are for illustrative purposes only. Financial planning should be conducted on a holistic basis as there are other relevant variables and tools that should be considered. For example, exchange traded funds (ETFs) provide another potential tool for tax deferral with their in-kind creation/redemption mechanics. As such, it is important to understand both the investment strategies and vehicles (e.g., mutual fund versus ETF) – especially in cases where wealth will not be spent but passed on to heir or charities (i.e., may receive step-up). |

Example 1: Retirement account versus taxable brokerage

I might label this first example as a strawman scenario as most people recognize the benefits of contributing to a retirement account versus not doing so. The point of my prior article was to quantify that benefit. So my goal here is to illustrate how to leverage those results. That is, I am not arguing for or against contributing to retirement accounts. Instead, I am providing a framework and some useful results that should help facilitate such decisions.

So let us consider a dollar earned by someone in their early 40s who does not plan on spending it until they are retired at, say, 65 years old. As highlighted by Figure 2 above, this dollar will be subject to income taxes at some point and the investor has some control over when that is. For this example, we will consider two options. The first is to pay taxes now and place the net amount in a taxable brokerage account. The second option is to effectively defer those taxes by putting this dollar into a 401K or IRA.

In this scenario, let us further assume their current tax bracket results in a 25% tax on income. Moreover, they expect to increase their earnings and wealth in such a way that they will land themselves in a 40% tax bracket down the road. If one only considers income taxes, then these tax rates indicate paying (lower) taxes sooner than later is better. However, this means their investments would not enjoy the benefits provided by retirement accounts (note: Roth example coming next).

As my prior article highlights, the average tax benefit from investing within a retirement account amounted to an approximately 1% more per year. Thus this situation boils down to weighing the lower income tax rate combined with a lower return in a taxable brokerage (due to taxes on dividends, interest, and capital gains) versus the higher tax but with higher returns. Given this time horizon of 25 years, the retirement account benefit would likely outweigh the higher income tax. For simplicity, let us assume the taxable return was 4% and the non-taxable return was 5%. Mathematically, this becomes a choice between ending up with $1.99 in a taxable brokerage and pulling $2.03 out of an IRA or 401K after 25 years. The figure for the taxable brokerage is actually worse (lower) than $1.99 because some of the $0.99 profit in the brokerage account will likely be subject to capital gains tax (i.e., it still carries tax liability) if the investments are liquidated for spending[3].

The above example should help illustrate that one should not focus on just one variable (e.g., minimizing one’s relevant income tax rate). It also shows how one can leverage the results from my last article to make some useful planning decisions. Of course, this example was contrived as to illustrate these points. Indeed, the next example shows some more (Roth) options investors typically have at their disposal to help optimize their planning.

Example 2: Traditional versus Roth IRA

The previous example was limited to a traditional IRA/401K or taxable brokerage. However, another consideration for many investors using a Roth instead of traditional retirement account. In my experience, this (the Roth option) is tool is under-utilized by many investors who would like to optimize their financial planning and after-tax returns. Unfortunately, this is likely the result from the complexities involved as well as some conflicts of interest[4].

Here I highlight two tax-related benefits provided by Roth contributions/conversions. The first is the ability to get more into retirement accounts. This is a relatively straightforward point but one many people miss. Assuming you have a maximum contribution limit and can choose between a Roth and traditional IRA, then the Roth option can allow you to enjoy the tax benefits on more money. However, one must have extra post-tax money to pay the taxes externally (i.e., not use the IRA assets to pay the tax). The following example should help illustrate this point.

| Example: Consider a hypothetical $4,000 limit on your contribution for someone who is currently paying a 25% income tax (at the margin) and expects to stay at that rate. Let us also assume this person has an additional $1,000 of post-tax money to be invested. In the case of a $4,000 contribution to the IRA, they will invest the other $1,000 in a taxable brokerage. On a post-tax basis, there is effectively $3,000 invested in the IRA (because 25% tax will ultimately be imposed). However, in the case of a $4,000 Roth IRA contribution where the taxes are paid with the external $1,000, the full $4,000 will enjoy the tax benefits of the retirement account. Et voile, an impressive 33% increase in the retirement account contributions and benefits ($4,000 versus $3,000). |

The second benefit of a Roth IRA I highlight is that it extends the longevity of tax deferral. This is especially beneficial when wealth will likely be passed on to heirs (more so for younger heirs). In the case of traditional IRAs, one is required to start evacuating their IRAs via required minimum distributions (RMDs) once they turn 70½ years old. When these distributions leave the IRA, that money no longer enjoys the tax benefits afforded by the retirement account. Roth IRAs have no such RMD requirements. As such, they can extend the longevity of those tax benefits – assuming the money is not required for spending.

The benefits of avoiding RMDs via a Roth IRA can be twofold. On the one hand, money that would have been distributed via RMDs stays within the Roth IRA and thus enjoys the associated tax benefits while the owner is still alive. On the other hand, it also allows for passing on more money within the IRA. This can amplify the tax longevity of tax benefits as it can then be distributed according to an inheritor’s RMD schedule. The value of this strategy can be significant. For example, I have met folks over 80 years old who still draw from inherited IRAs.

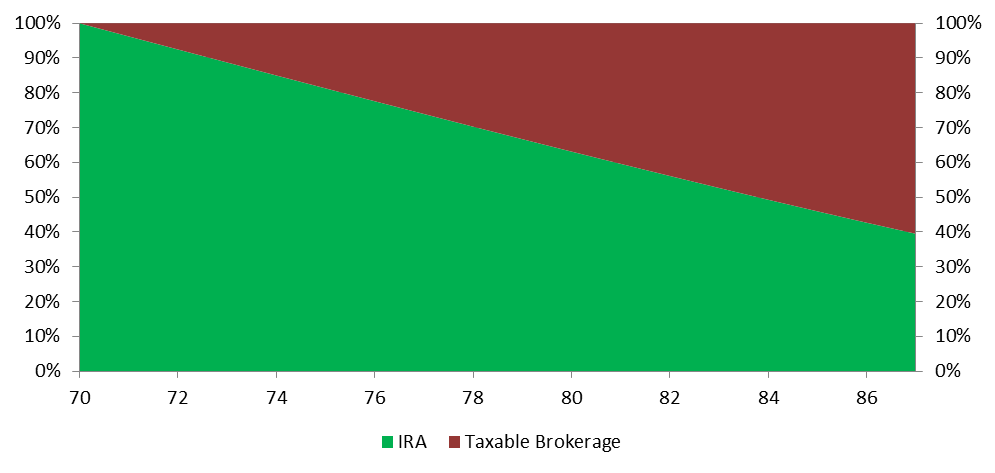

Figure 3: Percentage of IRA assets remaining vs distributed via RMD

Source: Aaron Brask Capital

Consider an investor who just turned 70.5 years old and is thus subject to RMDs for traditional IRA assets. Moreover, let’s assume their income and long-term capital gains tax rates are 25% and 15%, respectively. This person has an expected lifespan of approximately 16.5 years according to IRS mortality tables. Over these 16.5 years, RMDs will require approximately 60% of the IRA to be distributed[5] – presumably to a taxable brokerage account (see Figure 3 above). So these distributed assets would no longer benefit from the IRA’s tax advantages.

Leveraging the results from my previous article, let’s assume that the IRA tax advantages amount to an additional return of 1% per year – say, 5% returns in a taxable account and 6% in an IRA (Roth or traditional). In this case a Roth IRA which avoided RMDs would result in a little over 5% more money than a traditional IRA if the owner lived this expected 16.5 year lifespan.

This last example assumes the IRAs would be liquidated when the original owner passes. However, this is typically not the case and it certainly not the optimal way to leverage the IRA benefits. Indeed, an inherited IRA (traditional or Roth) can significantly extend its tax benefits as they can be distributed according to the RMD schedule of the inheritor (based on their presumably longer life expectancy). Thus, instead of assuming the IRA would be liquidated with all taxes being paid upon the passing of the original owner, the IRA could be distributed over a potentially much longer period (e.g., decades).

So let’s consider $1 inherited by a 55 year old in a IRA versus a brokerage account using the same return and tax assumptions above (inheritors will likely have different tax rates, but I make this assumption for simplicity). Applying the IRS rules for inherited IRA distributions (and assuming the inheritor lives at least as long as it take for RMDs to evacuate the IRA), the inherited dollar in the IRA becomes worth $4.24 versus $3.48 if inherited in a brokerage account (again assuming liquidation and all taxes paid). So this extension of the retirement account benefits increased the wealth by an impressive 22%.

In the case of a 25 year old heir with an even longer distribution period, each inherited dollar would turn into $19.54 for the IRA versus $13.87 for those in a table brokerage. That is a greater than 40% increase. The bottom line here is that extending the longevity of asset within retirement accounts can provide significant benefits.

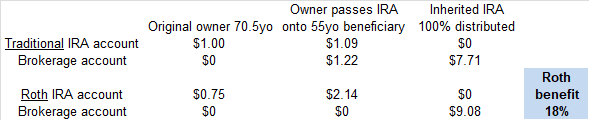

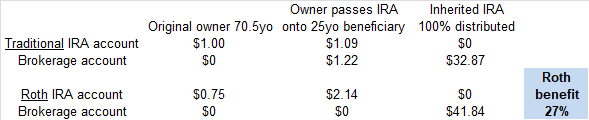

To be clear, the figures above should not be added (i.e., 5% and 22%). In fact, the net effect is slightly lower. This is because this different only applies to the extra dollars the Roth keeps within the retirement account (by avoiding RMDs) relative to a traditional IRA (recall that the IRA distributed over half of the assets to taxable accounts whereas the Roth did not). As such, I simulated the total benefit that would occur during and after the original IRA owner’s lifetime. These figures are presented below in Figure 4 and Figure 5.

Figure 4: The benefits of Roth IRAs and stretching with a 55 year-old inheritor

Figure 5: The benefits of Roth IRAs and stretching with a 25 year-old inheritor

Source: Aaron Brask Capital

These figures (i.e., 18% and 27%) highlight the tremendous benefits of passing wealth on via an IRA. In the case of Roth IRAs, the benefit is naturally greater as the absence of RMDs allows for more money to receive these benefits. In the above examples, I assumed the income tax rate was the same throughout (including for the beneficiary). As unrealistic as that may be, these examples highlight the magnitude of income tax differential that Roth IRAs can potentially overcome. As a corollary, this shows that relative income tax rates are not the only consideration when making decisions around retirement accounts.

This analysis does not include the first benefit I highlighted with respect to Roth versus traditional IRAs. In particular, the Roth allows one to put more money into retirement accounts when accounting for the tax liability a traditional IRA carries. Loosely speaking, $1 in a Roth is worth more than $1 in an IRA plus $0.25 in a brokerage. As such, the benefits could be even greater than those presented above.

Conclusions

My goal with this article was three-fold. First, I wanted to clarify some misconceptions and misinterpretations of my previous article on this topic (retirement account benefits). That is why I laid out a simplistic model to quantify the tax benefits of retirement accounts to ensure all comparisons would be apples-apples. The various factors I highlight must be considered together – not just on an individual basis. Indeed, it is entirely possible one may be better off actively choosing to pay higher income tax rates (as I show by example) if the other factors more than compensate for the tax differential.

Second, I wanted to provide examples showing how to leverage the results I quantified in my previous article. While that first analysis was tedious and required much effort, the corresponding results are straightforward and can be sensibly used in many contexts involving retirement account decisions.

My third goal was to once again illustrate the tremendous tax benefits retirement accounts can provide. Hopefully my hypothetical examples served this purpose. Indeed, the potential to increase wealth anywhere near the magnitudes in these examples will hopefully encourage more investors and professionals to conduct better due diligence around retirement decisions.

About Aaron Brask CapitalMany financial companies make the claim, but our firm is truly different – both in structure and spirit. We are structured as an independent, fee-only registered investment advisor. That means we do not promote any particular products and cannot receive commissions from third parties. In addition to holding us to a fiduciary standard, this structure further removes monetary conflicts of interests and aligns our interests with those of our clients. In terms of spirit, Aaron Brask Capital embodies the ethics, discipline, and expertise of its founder, Aaron Brask. In particular, his analytical background and experience working with some of the most affluent families around the globe have been critical in helping him formulate investment strategies that deliver performance and comfort to his clients. We continually strive to demonstrate our loyalty and value to our clients so they know their financial affairs are being handled with the care and expertise they deserve. |

Disclaimer

|

- Note: One can purchase annuities without these limitations. However, I make clear my opinions on these products in this note. Spoiler: Annuity fees often outweigh their benefits, but this does not stop many salespeople from selling them to get juicy commissions. ↑

- To be sure, there are other factors worth considering and I highlight some in the examples section. However, I focus on these three variables here to make things simpler and enable me to express the combined effects in a single mathematical formula. ↑

- I discussed this point at length in my previous article and presented the results for both liquidating the investments and leaving the invested (non-liquidated). ↑

- Less scrupulous advisors may prefer their clients to avoid Roth contributions or conversions since it often translates into fewer assets for them to manage and thus lowers their fee income. ↑

- I have assumed constant returns for this example. In reality, this is not the case but I believe it is a reasonable assumption to make my point. ↑