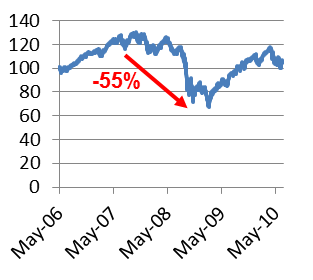

The financial crisis was not the primary driver of the market’s 50% collapse. The real 800 pound gorilla facing markets at the time was overvaluation.

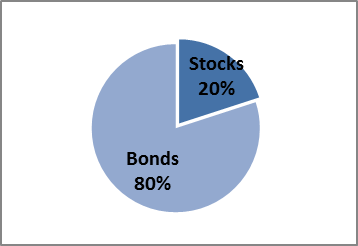

Continue readingAsset Allocation: Logic and Math Behind Risk and Return

We discuss why the conventional definition of risk misguided and how traditional asset allocation strategies can systematically dampen long-term returns.

Continue readingDestroying Steady Income

By treating income as an ancillary concern at best, many funds and portfolio managers effectively destroy what would otherwise be steady income streams.

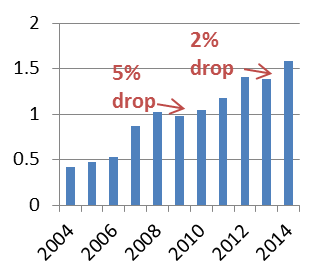

Continue readingMore Market Correction to Come

The recent spate of volatility in the global equity markets has caused some uproar amongst investors. We expect markets to fall another 30% or more before this correction is finished.

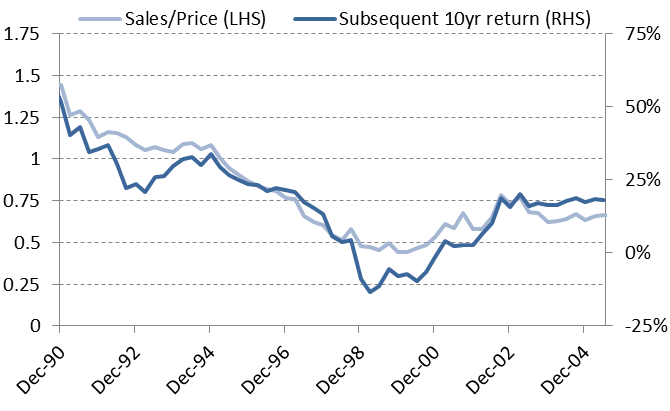

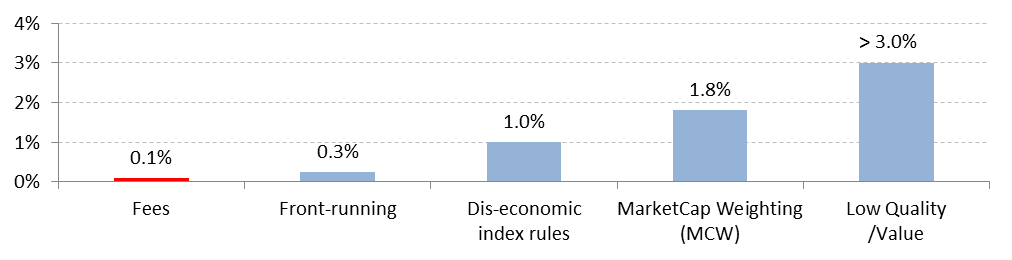

Continue readingIndex Investing: Low Fees but High Costs

Looking deeper into the mechanics and rules of index investing reveals subtle but real costs that can far outweigh the low advertised fees.

Continue reading