Three Key Investment Ingredients for Portfolios

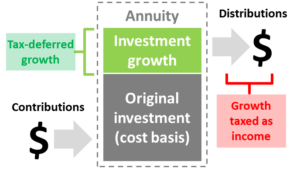

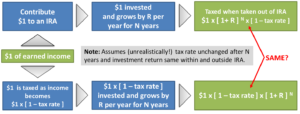

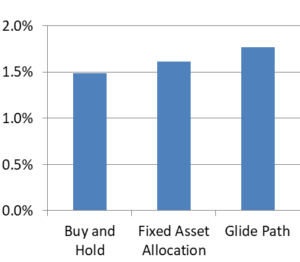

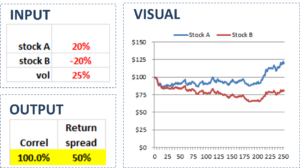

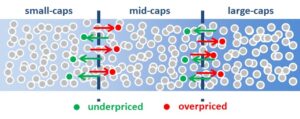

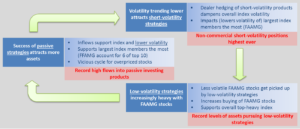

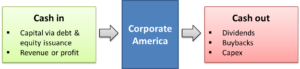

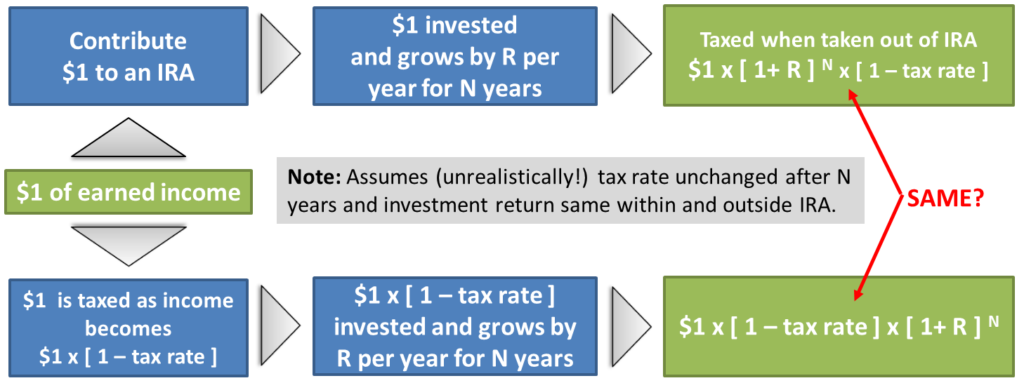

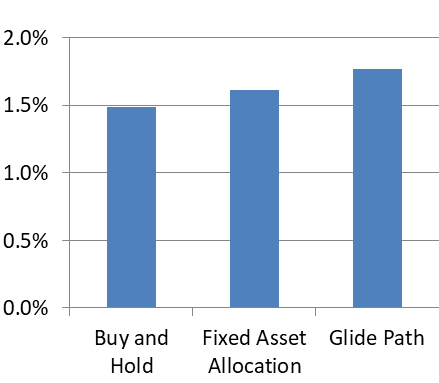

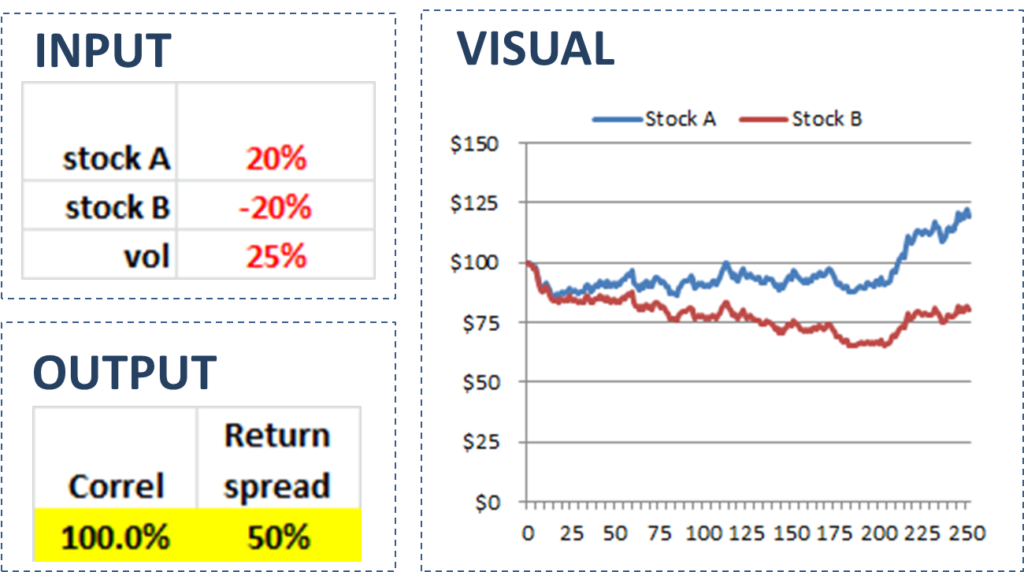

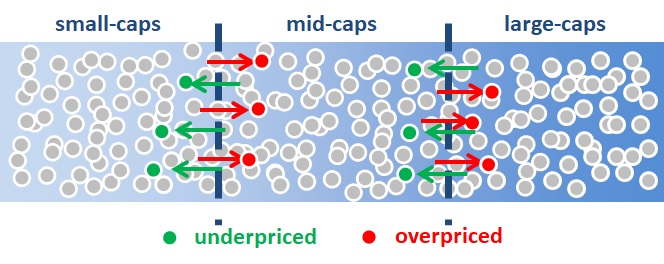

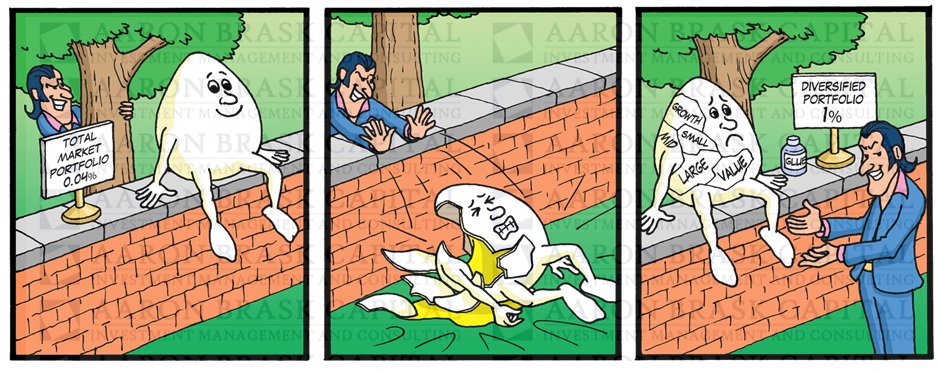

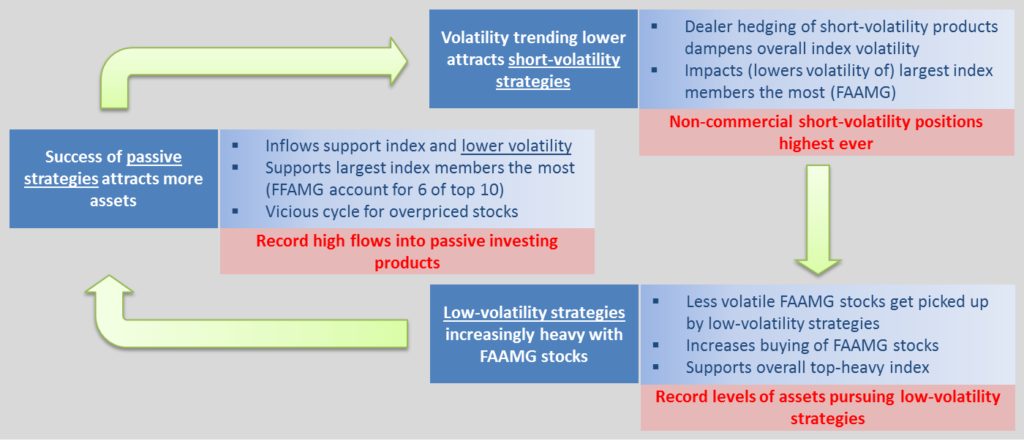

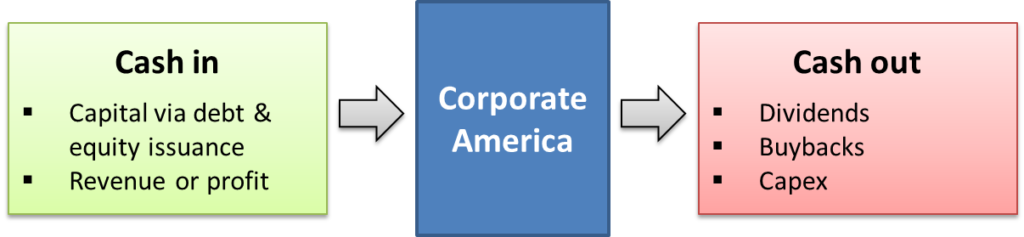

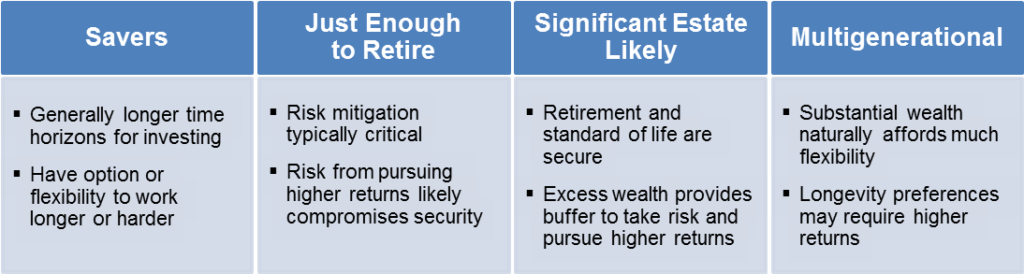

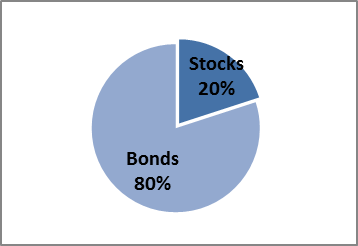

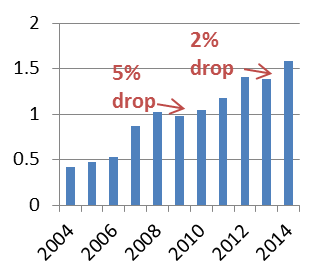

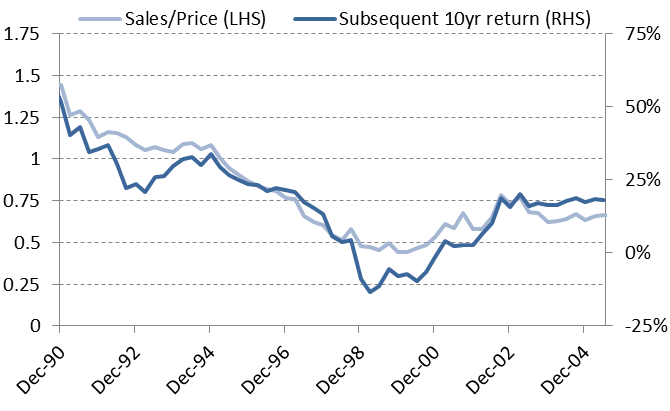

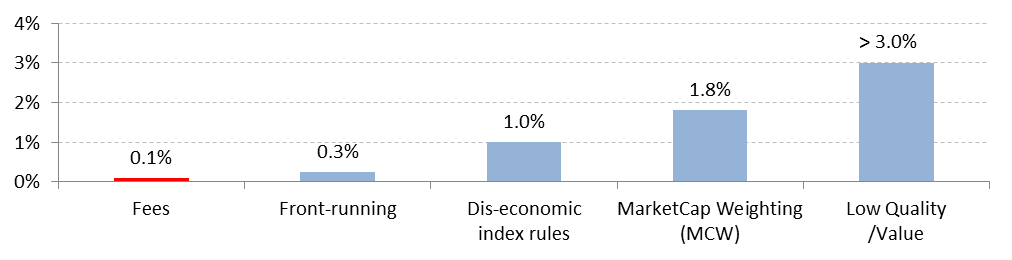

This video highlights what I believe are the three primary investment ingredients used for building portfolios (assets + strategies + products). Understanding this high-level categorization and how these ingredients differ